8 Steps to Buying an Austin House or Condo

-

Find a REALTOR® You Can Trust

An experienced REALTOR® will advise you through each step of the home buying process and help you understand your options.

-

Define Your Search Criteria and Timeline

An initial consultation with your REALTOR® to discuss needs and goals for the purchase will help to define your search criteria. Depending on your criteria and the state of the market, we can then establish a timeline for making the purchase.

-

Get Pre-Approved for a Mortgage

Unless you plan to pay all cash, obtaining a pre-approval letter from a reputable lender is the most important step before starting your home search. Not only does it help us focus on a certain price range to shop within, but it also allows us to present a more attractive offer to a seller (which can be very important if there’s a multiple offer situation).

-

Begin Home Search

Identify homes matching your search criteria and tour them, until you find the right fit! Click here to browse homes currently listed for sale.

-

Make an Offer

Your REALTOR® will help you prepare a formal written offer, with a price supported by recent sales and market statistics, and terms that are in your best interest. Be prepared for counter-offers, as they are common.

-

Go Under Contract

Once both parties have signed the final contract, the buyer writes two checks: an earnest money check to the title company (typically 1% of the purchase price; this is applied toward the buyer’s down payment and closing costs) and an option fee check to the seller (typically $100; this gives the buyer the right to terminate the contract for any reason before the end of option period, in which case the earnest money would be refunded).

-

Schedule Inspections, Repairs, and Insurance

The negotiated option period (normally 7-14 days) is a time to perform due diligence by scheduling inspections, obtaining estimates for repairs, and reviewing the Commitment of Title Insurance and other documents. Before closing, you will need to secure homeowner’s insurance, and you may want to get a home warranty, too.

-

Close the Sale

The buyer pays the balance due according to the Closing Disclosure (which is available at least three days before closing), either by wiring funds or bringing a certified check to the closing at the title company. Once all the paperwork is signed and the lender releases funds to the seller, the buyer becomes the new homeowner!

How Much Do Austin Properties Cost?

Investing in Austin

The future looks very bright for Austin real estate investments. In fact, in December 2014, HomeVestors ranked Austin as the top market in the country for single-family home investing. Here are a few reasons why:

- Austin’s diverse economy has helped it avoid the boom and bust periods of other cities. Austin is the capital of Texas, it’s home to UT Austin which has 50,000+ students and 24,000+ faculty and staff, it has some of the biggest names in technology (Google, Apple, Dell, Facebook, eBay, IBM, and Intel just to name a few), and it’s earned the nickname “Live Music Capital of the World”.

- People are moving here in droves - 157 people per day to be exact. In 2015, Forbes declared Austin as America’s 2nd fastest growing city. According to City of Austin projections, the metro area will grow from a population of 1.99 million in 2015 to 4.33 million in 2045.

- It’s a great place to live and work! Austin routinely appears near or at the top of lists ranking America’s most livable and business-friendly cities. Given the city’s natural beauty, plethora of festivals and events, laid-back and friendly culture, and warm sunny weather, it’s easy to understand why. View some of the latest rankings here.

Current Landlords: If you would like Austin Residence to produce a Fly Tour™ HD Video to help market and lease your property, click here.

Ask an Agent

Benefits of Buying Near UT Austin

- Build equity and receive great tax incentives through ownership. Condos are the most common purchase in the campus area – to learn more about condos near UT Austin, click here.

- Tremendous rental demand - if you need to rent out a bedroom or the entire unit as an investment, students sign leases up to 10 months before moving in. Rent prices in the UT and Downtown areas are the highest in Austin, and according to a February 2015 report produced by Apartment Data Services, Inc., the UT / Downtown / Riverside submarket is the hottest one in the city based on the combination of rental rate growth and absorption. Also, Capitol Market Research indicates that the campus area occupancy rate has historically been higher than the overall Austin rate, and by the end of each pre-leasing season most campus-area apartments reach 99% or 100% occupancy.

- In some cases, ownership allows you to establish Texas residency and qualify for in-state tuition.

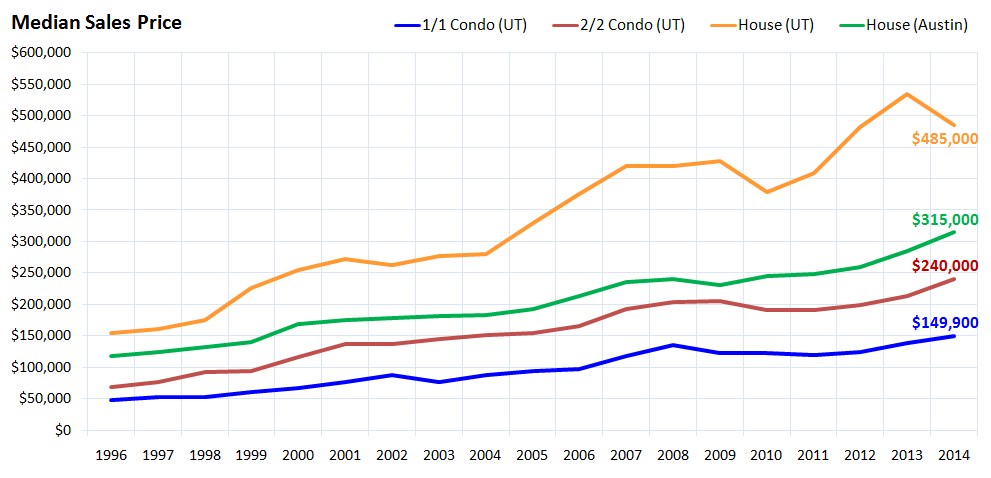

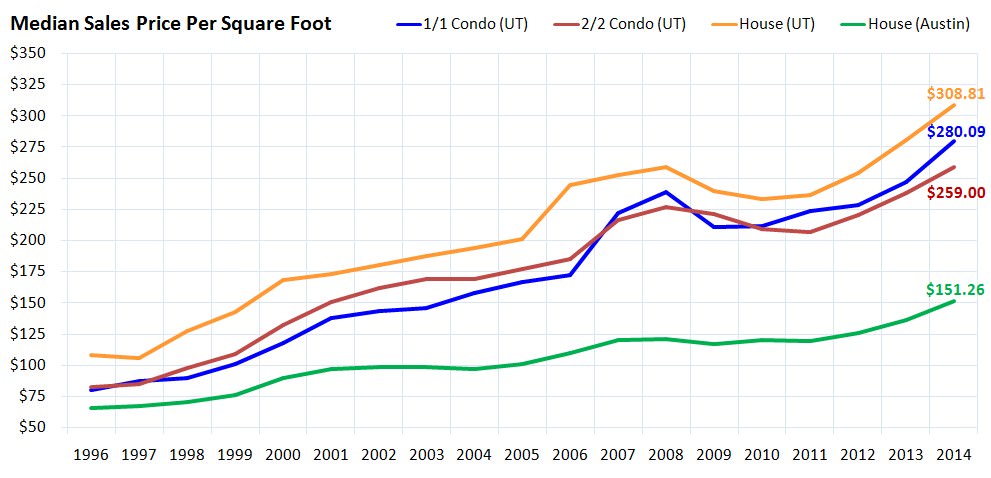

- Properties near UT Austin have historically had greater appreciation than Austin overall. Here are the historic annual appreciation rates from 1996 through 2014:

| Median Sales Price | Median Sales Price Per Square Foot | |

| UT 1/1 Condos (built in 1980s) | 5.9% | 6.6% |

| UT 2/2 Condos (built in 1980s) | 6.9% | 6.3% |

| UT Houses | 6.6% | 6.0% |

| Austin 1/1 Condos (built in 1980s) | 6.0% | 5.7% |

| Austin 2/2 Condos (built in 1980s) | 5.4% | 5.5% |

| Austin Houses | 5.6% | 4.7% |

| Austin Suburb Houses | 4.2% | 2.9% |